Agents everywhere, but what kinds, and how to price them

Agents are popping up everywhere. Vibe coding and good tooling have made it easy to develop agents. Users and buyers are looking for simple solutions that leverage AI.

Agents are popping up everywhere. Even Ibbaka is introducing an agent to help sales teams understand and execute on value selling.

The rise of the agent economy

Here are some data points that reinforce the impression that there is a surge in agent development and adoption (from DigitalDefyned).

Agentic AI Market Expected to Reach $48.2 Billion by 2030

According to Emergen Research and other industry trackers, the Agentic AI market — comprising autonomous agents that can make decisions, plan multi-step tasks, and adapt in real-time — is projected to grow from an estimated $2.9 billion in 2024 to $48.2 billion by 2030. This exponential surge is driven by adoption across autonomous enterprise workflows, generative process agents, self-optimizing industrial systems, and personal AI assistants capable of executing multi-objective goals. The compound annual growth rate (CAGR) exceeds 57%, signaling unprecedented industry momentum and investment.

Over 60% of New Enterprise AI Deployments in 2025 Will Include Agentic Capabilities

Gartner’s 2025 Emerging Tech Report states that more than 60% of enterprise AI rollouts this year will embed agentic architectures. These include systems that move beyond static inference to goal-seeking behaviors, like intelligent CRM agents that autonomously follow up on leads, or IT agents that proactively mitigate risks based on evolving signals. This marks a fundamental shift from predictive to proactive AI — a hallmark of agentic systems.

AutoGPT and Agentic Framework Usage Grew by 920% in Developer Repositories (2023–2025)

GitHub activity data shows that repositories using agentic AI frameworks such as AutoGPT, BabyAGI, OpenDevin, and CrewAI increased by 920% from early 2023 to mid-2025. The surge reflects developer demand for toolkits that orchestrate reasoning loops, memory management, environment interaction, and autonomous tool-use — all hallmarks of agentic behavior. Notably, LangChain and CrewAI are now integrated into over 1.6 million GitHub repos.

45% of Fortune 500 Companies Are Piloting Agentic AI in 2025

A McKinsey report from Q1 2025 highlights that 45% of Fortune 500 firms are running pilots or early-stage production systems with agentic capabilities. These initiatives include automated investment research agents in finance, self-learning legal brief generators, and “digital employees” for internal knowledge retrieval and proactive reporting. These agents are built atop foundational models like GPT-4o, Claude 3 Opus, and Gemini 1.5, enhanced with agentic orchestration layers for autonomy and interaction.

That is a lot of agents jostling for attention and adoption.

Two approaches to agents - net new or to accessing existing functionality

In mid June, Ibbaka posted a poll on LinkedIn asking about plans to introduce agents. The poll was shared across the AIX (Artificial Intelligence Exchange), PPS (Professional Pricing Society), Design Thinking, and Software as a Service groups. As of June 14 there had been 79 responses.

The most common approach to introducing agents comes from existing software companies. This was almost 50% of the responses. There are many examples of this. The most prominent is the Salesforce Agentforce initiative, but there are many others. Revenue Intelligence Platform Gong has introduced a set of 14 agents, Hubspot has five new agents on its Breeze AI Platform, and a quick prompt into your favorite AI will find dozens of others.

We are seeing three basic patterns here. One can provide an agent to …

Replace some existing well-defined piece of functionality or task associated with that functionality. Example: Pricing agents are replacing price optimization functions at the deal level.

Complement existing functionality and remove frustrations or usability blocks. Example: an agent could monitor e-mail, Slack, or MS Teams and call records and keep the CRM updated.

Explore new functionality that leverages the user base, the data, and the ability to connect previously unconnected systems. Many of these explorations are actually being created by users, see below.

There are also many net new agents being brought to market. Some of these are from new companies set up specifically to execute on agent-first strategies. This has been an active area of investment, and many companies are sprouting up: Brighthive, Synthetic Users, Wildcard (very new with an MCP focus), ToothFairyAI (love that name), and on and on. Ibbaka is bringing out the valueIQ.ai agent this summer.

A third approach to introducing agents is to provide users with the tools needed to build their own agents and, in some cases, to provide marketplaces where users can share agents with each other. We wrote about this in Your customers will be building their own agents for your platform - how will you price this?

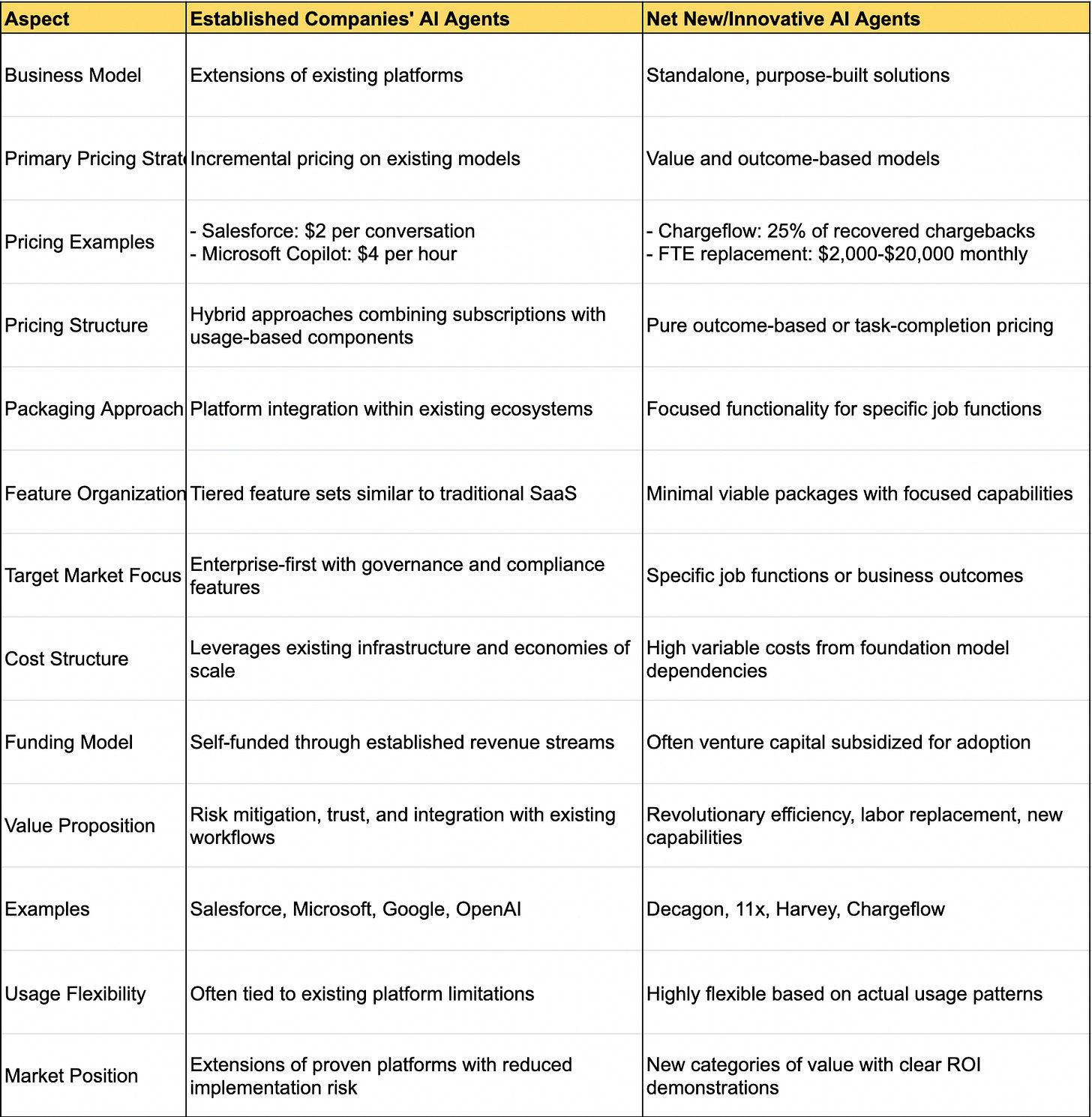

Pricing Net New Agents vs. Agents Built on Top of Existing Applications

Pricing approaches are quite different for AI native companies versus agents from established companies. There are several reasons for this.

AI native agents

have a clean slate and can design the agents and their pricing to align closely with value

are easier to cost as the main operating costs will be (i) compute and (ii) the cost of other services called

Agents layered onto existing applications

have to address framing and anchoring effects of the underlying application; in most cases, the agent pricing needs to be only a fraction of the pricing of the underlying application

have to take into account the value of the agent and the value of the existing application and data, and the dependencies can be complex

can have more complex cost dynamics, and it can be difficult to allocate costs between the agent and application

Pricing of AI native, standalone agents and agent families can use the Ibbaka agent pricing layer cake.

Pricing agents layered onto existing applications will generally need to begin by seeing how the agents fit into the framework provided by the existing pricing model. Consider the following…

How is the existing application priced?

Outcome-based (highly unusual)

Value-based

Cost plus

What pricing metrics are used for the existing application? Are these candidates for pricing the agent?

Is the introduction of agents an opportunity to reframe the existing pricing?

Does the agent add new value drivers, or does it enhance existing value drivers?

Is the agent independent of the existing application (can it be purchased separately)?

Does the agent require a subscription to the existing application, or can the existing application be bundled into the agent?

Does the pricing of the agent change depending on which package it is associated with?

Is the agent

Part of a package?

An add-on to a package?

Independent of packages?

Conclusions

We are witnessing a transformative moment in the evolution of AI, with agentic systems rapidly moving from experimental technology to mainstream business enablers. The explosive growth in market size, developer adoption, and enterprise pilots underscores how agents are reshaping everything from sales and customer engagement to internal operations and knowledge work.

As organizations grapple with the choice between building net new agents or integrating agents to unlock more value from existing systems, they have some difficult decisions to make. It is easier to price net new agents. And even agents that rely on existing applications can be packaged this way by subsuming the application under the agent.

Even so, leveraging existing applications and platforms, with their established users and well-understood value propositions, will be a better path for many companies. These companies will need to either frame agent pricing within their existing pricing model or take advantage of the introduction of agents to reframe overall pricing design.